By now, the inflation scam is self-evident to anybody who wants to see it. Robert Reich and others blame corporate greed, which it is. But that’s too vague. Our current inflation, rising prices, would not be possible unless the currency supply was increased to accommodate that inflation. Which it has, massively. The supply chains are an ongoing political crime but inflation is not because of shortages. Inflation is because trickle down economics has become a river of corporate corruption and crony capitalism, fueled by the excessive money printing to cover the absurd amounts of market profiteering.

Counterfieting causes inflation. Without the explosion of new money corporate lizards wouldn’t be able to make multi-million dollar salaries. There would be no alternative but to raise taxes on those who deserve exactly that. The following graph shows that Crypto is a theft from the taxpaying public. Crypto is merely a money laundering scheme by the Fed and their counterfieting friends. That’s why we have inflation. Take a look at the following graph. I have layed crypto value overtop the currency supply. Crypto would be impossible without the counterfieting. The graph shows billionaires have been “leveraged” into existence.

Crypto has crashed now, along with all the markets. Which proves the scam is monolithic and global. The easing music has stopped and the flood of free money is tightening now. The smart money has already cashed in their chips. The corporate lizards are fat & happy from the scam. The public on the other hand will be extracted. The spike in the graph is the extraction scam being reconciled, by counterfieting money, which causes inflation.

Inflation is a tax on the public by the establishment. Corporations and investors are protected from the scam, for the most part, by cost of living increases and putting their disposable income into “exchanges” or the “markets”. That’s where investors “trade” theoretical promissory values. They are bought and sold for fluctuating prices. The values rise from taxpayer subsidies and fall from investor profit-taking.

It’s an extraction scam.

The financial industry created their own financial crisis and to “correct it”, they decided they would become billionaires by putting trillions of dollars of public debt, “off the books”. That way they could keep the ill gotten gains they got from their hyper-inflated dot-com stocks. Those profits led to the money printing which became the most used emergency superpower in the Fed’s financial toolkit. The establishment has extracted trillions of dollars from the public for decades, and claim the only remedy now is going to be painful layoffs for the working folks. Hard times coming for the common man, they say, without mentioning the obvious solution, which is;

Tax the obesely wealthy, to the max.

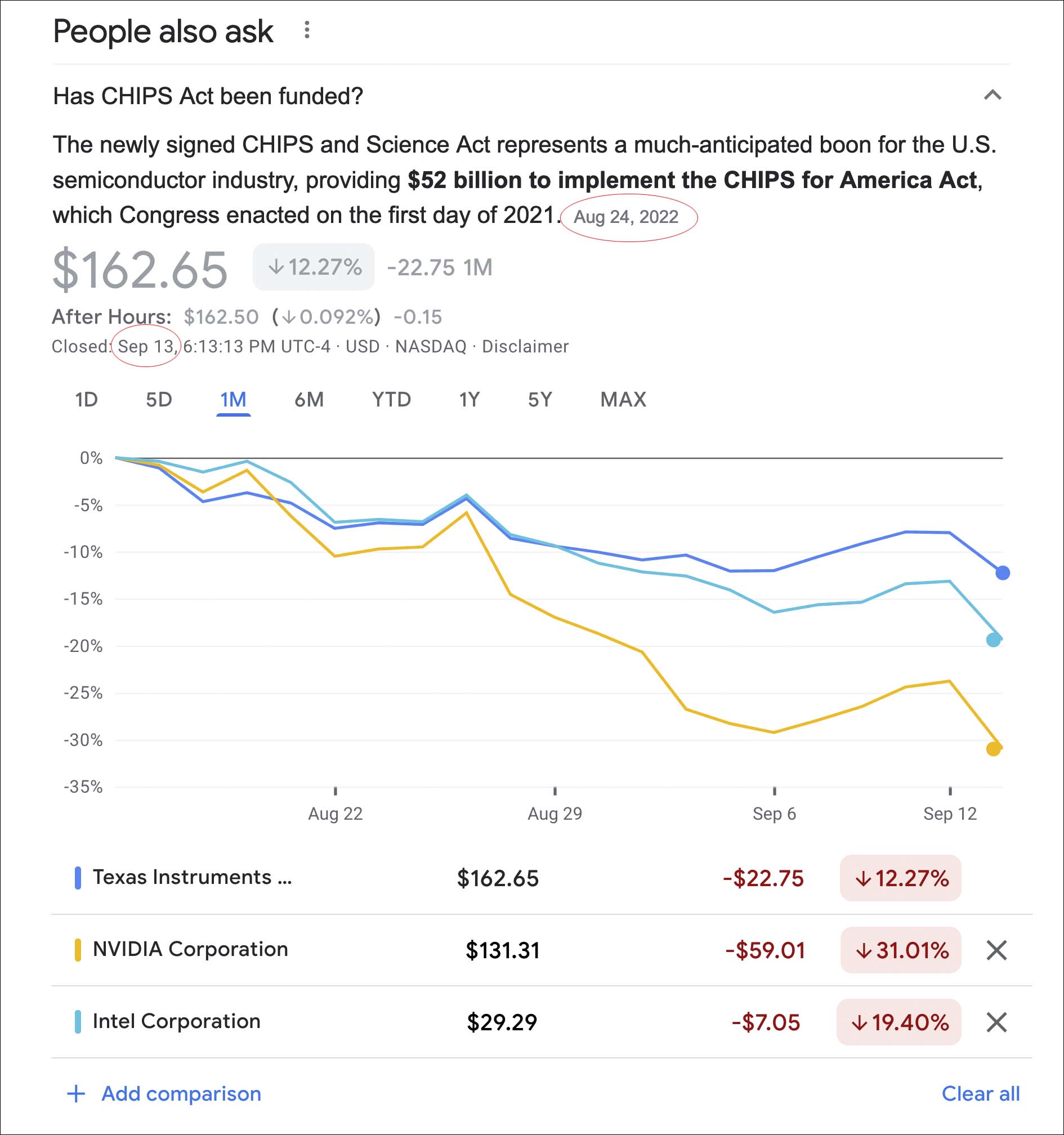

The Chips Act is a perfect example to deconstruct the fraudulent narrative that serves as the definition for our so-called “free-market” economy. It’s a perfect example of the government being everything everybody supposedly believes it’s not. Funny how they don’t seem to notice what they don’t want to “believe”. Free market capitalism is what they preach but that’s not what it is.

Our money has been extracted from the very recession they say is coming now, which will reconcile the deficit. They profit by stealing our money from the future until the debt can no longer be leveraged. That time is at hand. So the easing now becomes the tightening and the real reconciliation will begin, with a recession.

The perpetual financial crisis that made them all rich is now a problem, they say, so the rest of us get to suffer. They will reconcile their market gains now, moving forward, with a monster recession for the rest of us. The workers and the uninvested will be forced to pay more with less. We get our savings devalued with inflation and our purchasing power diminished, and a bunch of your cozy little corporate cubby hole jobs will disappear. Turns out your job wasn’t really necessary in the first place. It was just “good” for the economy.

But I digress. Back to the example here with the Chip Act. I’d like to ramble on but the inflation has already got me scrambling to keep up here, in real life. So, I don’t have time to get into all that now. I’ll just focus on the semiconductor subsidy.

This was considered a political victory, somehow.

Here’s an article that reports the Chip Act, or CHIPS.

https://www.investors.com/news/technology/chips-act-semiconductor-stocks-likely-to-benefit/

Nobody says where the money is coming from, but of course, we know. We’ll create 50 billion, or borrow it, on the public’s tab, and call it capitalism.

This time the thousands of millions of dollars are allegedly to keep chipmakers from moving all of their facilities to the Far East. Sure it is. In the final analysis the public will be paying investors for their free market gains, as usual, and it won’t make a lick of difference in the cost of the chips to consumers. In the end we’ll pay more and lose the jobs to China anyway.

Our public policy doesn’t benefit the public, because corporations control our government. They squeeze the public for more investor profits instead of representing us, as intended. This policy is not capitalism or the free market, or democracy. By any other name it is corporate socialism. It is another strategy among many to help sustain the larger scam of global free market economics.

The chip act is just another fang in the public’s neck in order to pretend that capitalism is a viable business model and not a political crime against the public. It is the conflict-based economy pretending to work when in reality, it only works for some, by working against the consumers, the public, and the greater good.

The amendments to the act, to prevent stock buy backs and stop shipping our jobs overseas failed, yet they passed a law against selling our chips to China. As if China wants our chips. So everything that could be right about this democratic victory is actually wrong, as usual. It’s just another way for the establishment to squeeze the taxpayers for profits, while pretending they’re doing something good for them, when they’re not. Their capitalist success is actually corporate welfare.

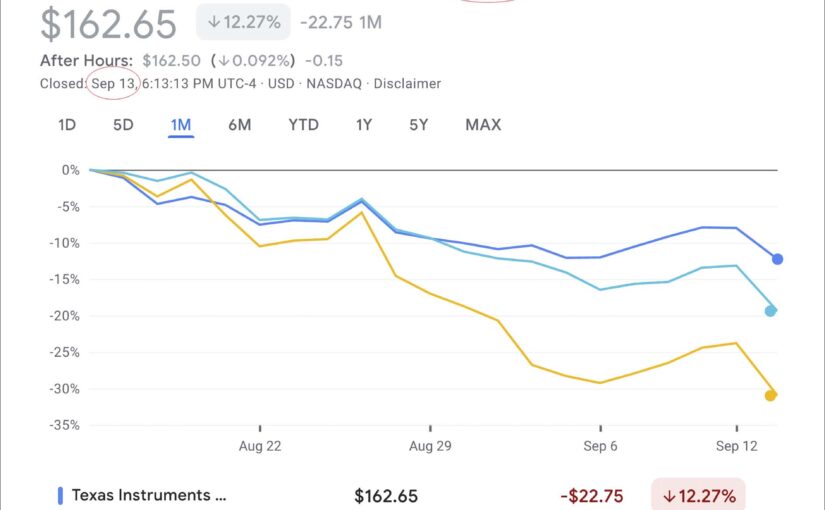

And it gets worse. In the three weeks since the act was passed the semiconductor stocks have crashed. Those companies that will be subsidized have lost twenty to thirty percent value in three weeks. That shows either, one, the wave of the coming recession considers the corporate welfare money already spent. (The value has already been consumed with previous financial exuberance and overcompensated profit-taking.) Or two, the stocks have intentionally tanked for another round of profitable stock buybacks for the investors. Or most likely a little bit of both. CEO’s will be buying into the recession, as usual, while workers sell their retirement money at a loss.

I’m including the graph here in the post, showing the beneficiaries of the chip act have tanked in the last few weeks, contrary to the promoted expectations. The entire effort seems to be a ploy to scam people into investing in their stinky stocks. Investors anticipated gains from the public’s money. But no, the market movers not only took the gains from those who invested before the crash, they will likely syphon off the funds allocated for the production of the semiconductors as well.

It’s a win win for the so-called free marketeers.

The free market is anything but free. The free market costs the taxpayers plenty. That’s how our “system” “works”. We should call it what it is if we want to revise it, and we do. By all accounts our money has been taken, and now, because the government believes in this kind of market profiteering they’ll let the public pay the tab, as usual, while the profiteers consolidate their wealth into illegally sanctioned tax havens.

The bottom line of our economic model is that it does not work for the public. It’s an extraction scam by people who have decided, for themselves, that it’s okay that they own the automation the public needs to survive. They charge you and consumers an ever-increasing amount so that they might maximize their profits, at your expense. You are either with them or against them.

We practice economic division by design. Division goes against the philosophical intention of a civilized society. Division is antidemocratic and goes against constitutional law and all moral thought as undoubtedly understood by all contentious thinkers whose minds have gravitated to such places. Usury fees were outlawed a long time ago. It’s not hard to understand why.

Imagine a fund where you deposit your hard earned savings, in hopes that one day you will have enough money to stop working. Imagine now that fund also has institutional investors borrowing money to help grow that fund. They pay near zero interest so their borrowed and over-leveraged investment grows along side of yours, like a financial cancer. Or a vampire if you will. Once your fund is artificially inflated beyond its logical growth, the institutions sell their shares and the value of your retirement is diluted to profit the institutions who borrowed the money to scam you. Your retirement relies on the timing of their extraction “cycle”.

You need your money to retire, so only way to pay for their excessive gains is by creating new money. The entire economy has become a counterfeiting and bribery scam now, pretending to be something other than unethical. And nobody seems to mind.

We have a system where one side creates money from thin air and forces the other side to compete for it. That’s the true political spectrum. The practice has a deficit of billions of dollars a day. And then we vote for people who supposedly believe what we believe, and we hope that will produce a representative government and reduce inequality.

That idea has long since failed.

Clearly something’s not working here. The correction starts with the fundamental understanding that money is representation and not belief. Nobody should have to care what somebody else thinks. The economic status and well-being of the public should be a primary variable in apportioning congressional delegations to the states, as previously explained on this website. I’ll get back to that asap.